-

NEW Fleet features in our Driver App

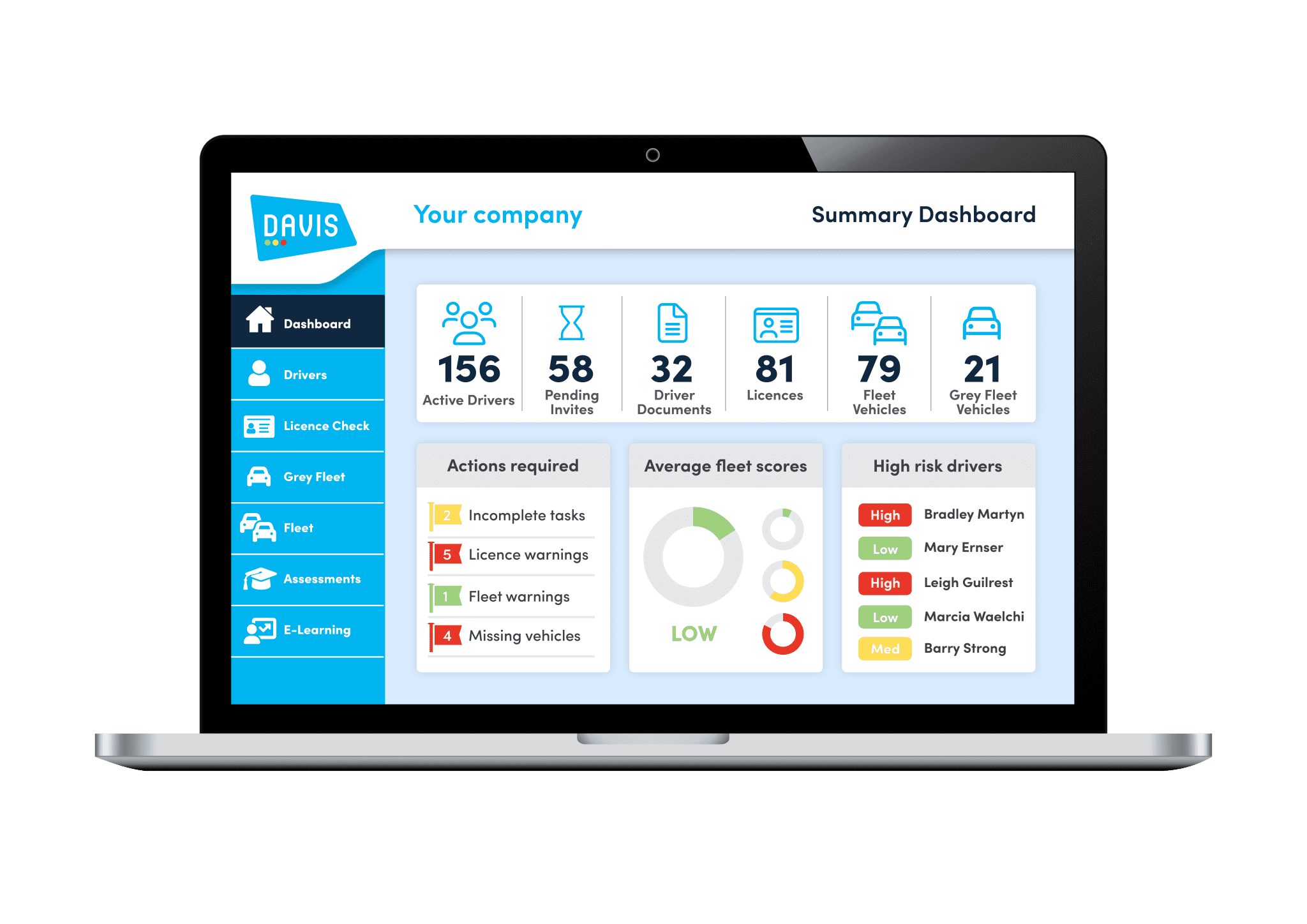

Record mileage, receive documents, complete vehicle inspections - drivers can do all this and more in our Driver App giving Fleet Users more control than ever before

Find out more

DAVIS can save you time and money

Use our new calculator to see if automating your driving licence checking process will benefit your business by saving time and money

Try it now

What makes DAVIS better than the rest?

Flexibility, simplicity, automation and the ability to customise settings, processes and workflows. Our award-winning platform can help your business become more efficient and sustainable.

Get in touch

We go the extra mile to ensure client data is stored securely. We hold ISO 27001 and cyber essentials plus accreditation. In addition the platform is hosted on Microsoft Azure which features the most up to date cloud security technology including state of the art physical and virtual protection, automatic failover to maintain continuity and instant back up to a second data centre.

We’re also able to offer companies a Single Sign On option to improve password management and enhance identity protection with the inclusion of two factor authentication. Upgrading to SSO also has the benefit of having a bespoke URL and company branding to improve the overall user experience.

We check driving licences for companies across the UK to give employers evidence that you have a valid driving licence and you have the correct vehicle entitlement to drive. Not only is it a legal requirement but it helps make the roads safer too.

Before any checks can take place, it’s essential that your employer gains your permission to check your DVLA record. This is managed entirely through DAVIS in one of several ways. Once permission is granted, your licence will be checked (and in most cases rechecked on an ongoing basis) and results will be stored in DAVIS.

If you drive your own vehicle for work purposes, it’s likely that you’ll be asked to provide some additional information about the vehicle you drive. Once again, this is a legal requirement as the company you work for is required to check your vehicle has the necessary tax, mot and insurance to ensure it is roadworthy.

You can read more about how we process your data here but if you’d like to see our driver workflow to learn about the tasks you may be asked to carry out, click below to reveal the process.

Our Plans

Watch our three minute demo

Permission 6 Ways

Choose from 6 driver permission methods

We know that each business is different, and that’s why we cater for every eventuality and scenario when it comes to collecting driver permission. Dependent on your set up or preference, we can have your drivers onboarded and checked in DAVIS within as little as 30 minutes.

Let the numbers do the talking

0K

active drivers in DAVIS

0M

driving licence checks completed

0K

active vehicles in DAVIS

Quantifying your risk

We get it, taking control of corporate driving compliance can be daunting. Where do you even start? We can help. With DAVIS Driver Audit, we go straight to your employees to determine whether or not they drive for your business, then we identify what they drive (own vehicle for example) and the type of journeys driven.

Get in touch

Get In Touch.

Get pricing

Book demo

Talk to sales